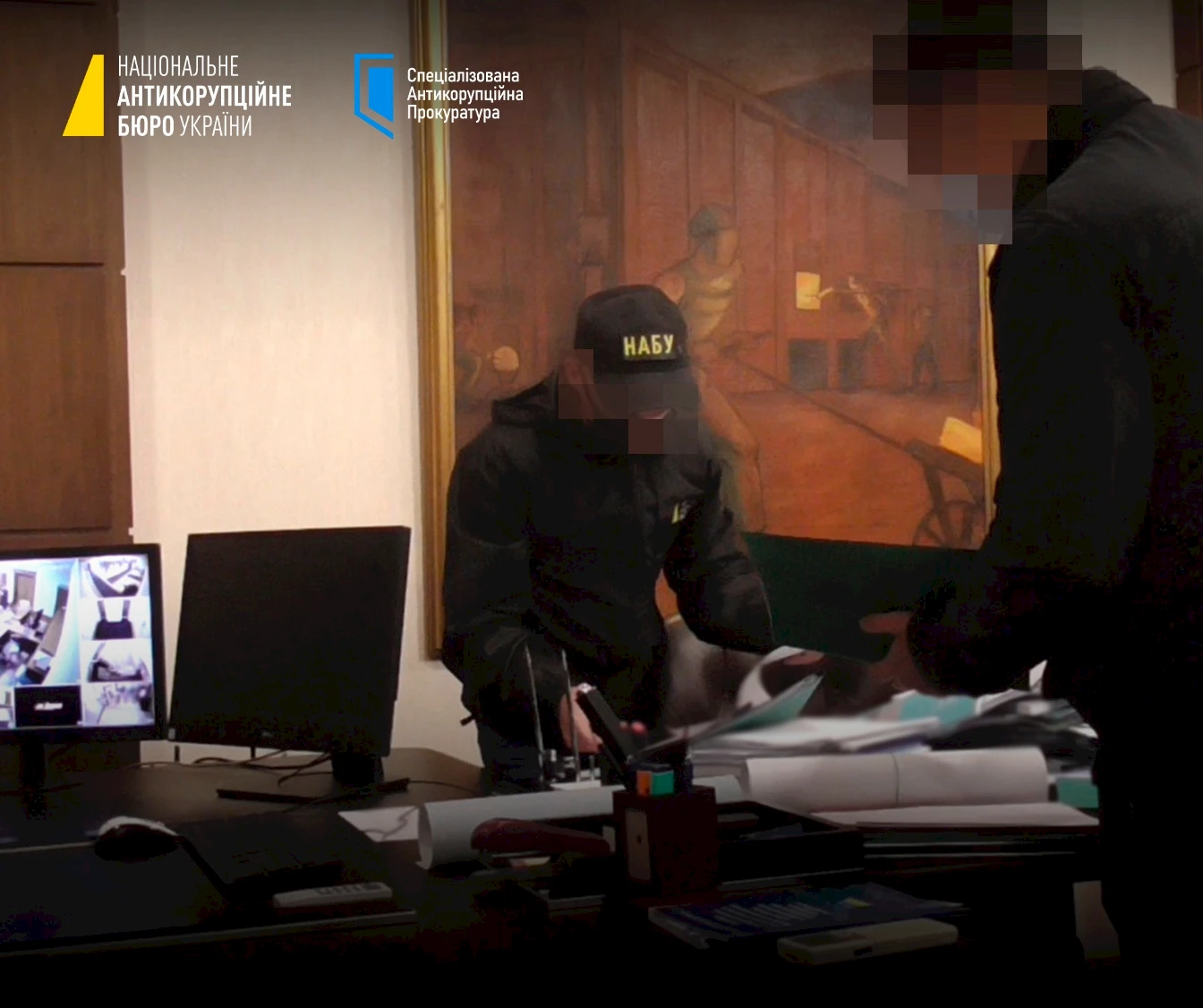

Corruption in Tax Service: massive VAT scam with UAH 15 billion turnover exposed (PHOTOS)

NABU and SAPO, in cooperation with the Security Service of Ukraine (SSU), have exposed former senior officials of the State Tax Service of Ukraine — the ex-head of the Service and the deputy head of the Main Directorate of the Tax Service in the Poltava region — for abusing their official positions in the interests of a criminal organization.

According to the investigation, members of the organization established a large-scale criminal network and engaged over 200 controlled companies to implement a scheme aimed at minimizing tax payments.

The criminal mechanism involved:

-

preparation of tax invoices with false data regarding business transactions with real enterprises;

-

registration of these invoices in the Unified Register of Tax Invoices;

-

use of such invoices by real companies to unlawfully reduce their tax liabilities.

Between 2020 and 2023, the network issued tax invoices with false data on the supply of goods and services totaling UAH 15 billion. The “schematic” value-added tax (VAT) involved in the scheme exceeded UAH 2.3 billion.

The investigation established that the then acting head of the State Tax Service of Ukraine facilitated the unhindered operation of the network, while the deputy head of the Poltava Tax Directorate — who chaired the commission responsible for suspending the registration of tax invoices — ensured favorable decisions for the network’s companies.

As a result of this scheme, real enterprises unlawfully avoided paying UAH 147 million to the state budget.

The criminal organization operated with a high level of coordination and secrecy, using remote servers located abroad to store documents, multiple VPN configurations to mask IP addresses, foreign mobile numbers, as well as bribery and pressure on nominal company officials.

NABU detectives uncovered and decrypted detailed records of illicit gains maintained by the tax officials.

Currently, 11 individuals have been served with notices of suspicion.

Legal qualification: Part 1 and Part 2 of Article 255, Part 3 of Article 212, Part 2 of Article 364, Part 4 of Article 368, and Part 3 of Article 369 of the Criminal Code of Ukraine.

The head of the money-laundering network was detained under Article 208 of the Criminal Procedure Code of Ukraine while attempting to leave the country.

The pre-trial investigation was initiated and carried out with the operational support of the SSU.

According to Article 62 of the Constitution of Ukraine, a person is considered not-guilty in the commission of a crime and cannot be subject to criminal punishment until he or she is found guilty by court.